Important Ratios For Banks. The ratio is considered an important profitability ratio, indicating the per-dollar profit a company earns on its assets. The debt-to-equity ratio enables investors to compare the total stockholders' equity of a company (the amount stockholders have invested in the company plus retained earnings) to its total liabilities.

They have not been reviewed for.

The ratio is considered an important profitability ratio, indicating the per-dollar profit a company earns on its assets.

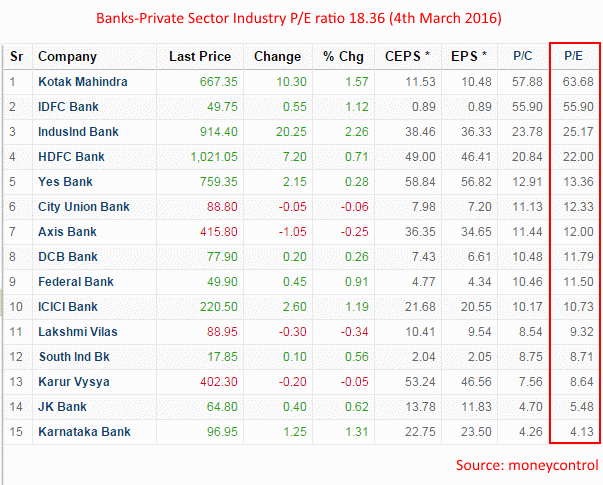

A lower ratio indicates that a company is undervalued. Since bank assets largely consist The ROA ratio is a company's net, after-tax income divided by its total assets. Bank-specific ratios, such as net interest margin (NIM), provision for credit losses (PCL), and efficiency ratio are unique to the banking industry.

:max_bytes(150000):strip_icc()/bank-5bfc2ef246e0fb00511a4ea6.jpg)